On September 2, 2020, in the midst of the worst economic crisis since before World War II, the S&P 500 index reached a record level of 3,580, representing a year-to-date increase of about 9 percent in value. Since then, the US stock market has been resilient in the face of continuing concerns about the global pandemic and the lingering recession. Some economists and investors claim that the stock market is no longer guided by economic fundamentals but is instead leading a life of its own—one detached from reality.

We disagree.

The US stock market has remained resilient during the COVID-19 crisis because of three critical factors that reflect certain truisms about valuations, the market’s composition, and investors’ expectations. These factors are very much grounded in reality.

The stock market takes a long-term perspective. Today’s investors realize that even if it takes two or three years to restore a normal level of GDP and profits, the pandemic’s long-term effect on share prices will not be that high. The math explains why. No one knows the extent or length of this economic recession. But let’s assume that for the next two years, corporate profits will be 50 percent lower than they otherwise would have been and will then return to their precrisis levels and growth rates. If we discount the impact of lower short-term profits and cash flows, the present value of the stock market declines by less than 10 percent (Exhibit 1).

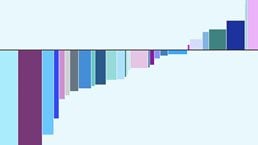

The stock market does not set a value for the market as a whole. The market values individual companies from many different sectors, and these companies add up to the whole. Especially now, performance differs vastly within and across sectors. Companies in oil and gas, banking, and travel, for instance, have been significantly challenged during the pandemic, and their performance is down. Within the retail sector, grocery stores have generally fared well but department stores have not. Some companies in pharmaceuticals and in technology, media, and telecommunications (TMT) are actually doing better now than they were at the beginning of the year—in part because the introduction of new products and services affects them more than the health of the broader economy does. As a result, the stock market’s aggregate value remains resilient.

Would you like to learn more about our Strategy & Corporate Finance Practice?

This dynamic is even more pronounced now that the TMT sector carries greater weight than ever before: its share of the top 1,000 companies has increased from about 14 percent at the end of 1995 to about 35 percent in September 2020. Alphabet, Amazon, Apple, Facebook, and Microsoft collectively account for 21 percent of the market’s value—up from 2 percent in 1995 and 16 percent at the beginning of 2020 (Exhibit 2). Without these five megacap companies, the value of the 2020 market would have increased by only 3 percent (versus 9 percent). And without the TMT sector as a whole, there would have been zero growth.

The market value of listed US companies doesn’t reflect employment or GDP levels in the real economy. As we have said, companies from high-growth sectors that have done relatively well during the crisis now heavily weight the US stock market. By contrast, many sectors that have done worse account for a smaller share of the market and often have few listed companies. Many apparel retailers and department stores, for example, were already under pressure even before the pandemic, and their market values were low. The current collapse of these companies’ share prices does not have much impact on market aggregates. Many of the construction and professional-services firms, gyms, hairdressers, hospitals, restaurants, and other service businesses that generate lots of jobs and contribute materially to GDP are not even listed. The overall stock market can do relatively well even when employment and GDP are severely depressed (Exhibit 3).

Similar dynamics are at play in Europe and Asia. The European market, for instance, is only 6 percent below precrisis levels. Variations in performance across sectors resemble those we find in the United States, and as in the United States, the composition of the European index does not reflect real-world GDP and employment contributions. One important difference is that there are no European megacap companies and fewer technology companies overall. In Europe, for instance, TMT companies account for only 10 percent of the market, versus 35 percent in the United States.

Market valuation of sectors in 2020

The disproportionate weight that the TMT sector and a handful of companies in that sector carry in the market could turn into a risk if investors decide to drop their growth expectations for even a few TMT companies. But the numbers show that the US stock market is neither irrational or erratic; the specific mix of industries in it has played a big role in making it more resilient than the economy as a whole.