A landmark report from the McKinsey Global Institute warned that demand for workers with technology skills would rise by 55 percent from 2016 to 2030 (PDF). In the insurance industry, the growth in demand has already had an impact on back-office roles, especially contact centers. The need for employees with technology skills will only increase in these and other functions, including claims and actuarial roles, frontline sales, and underwriting.

While insurance leaders have accepted the inevitability of a digital transformation, they seem to be struggling to adapt their workforce to this new reality—even in global business hubs teeming with talent, such as London. To learn more about insurance companies’ current digital and analytics talent in the United Kingdom, we analyzed the digital and analytics skill sets of employees in the UK insurance market and compared these findings to the skills of peers in other industries and in best-in-class technology companies (see "About the Research" below). Our findings are striking and confirm the assumptions of many: just three in ten UK insurance employees possess skills in at least one of six digital and analytics categories—half the proportion found in global tech giants. When we analyzed whether there’s a correlation between business performance and the presence of digital and analytics talent, we found that, among a small subsample of UK insurance companies, the greater the proportion of digital talent a company has, the more profitable it is.

While not exhaustive, our findings point to an urgent need for UK insurers to get serious about recruiting tech talent, reskilling current employees, integrating new capabilities, and building a culture to sustain a talent pipeline.

UK insurers with a higher proportion of tech talent do better . . .

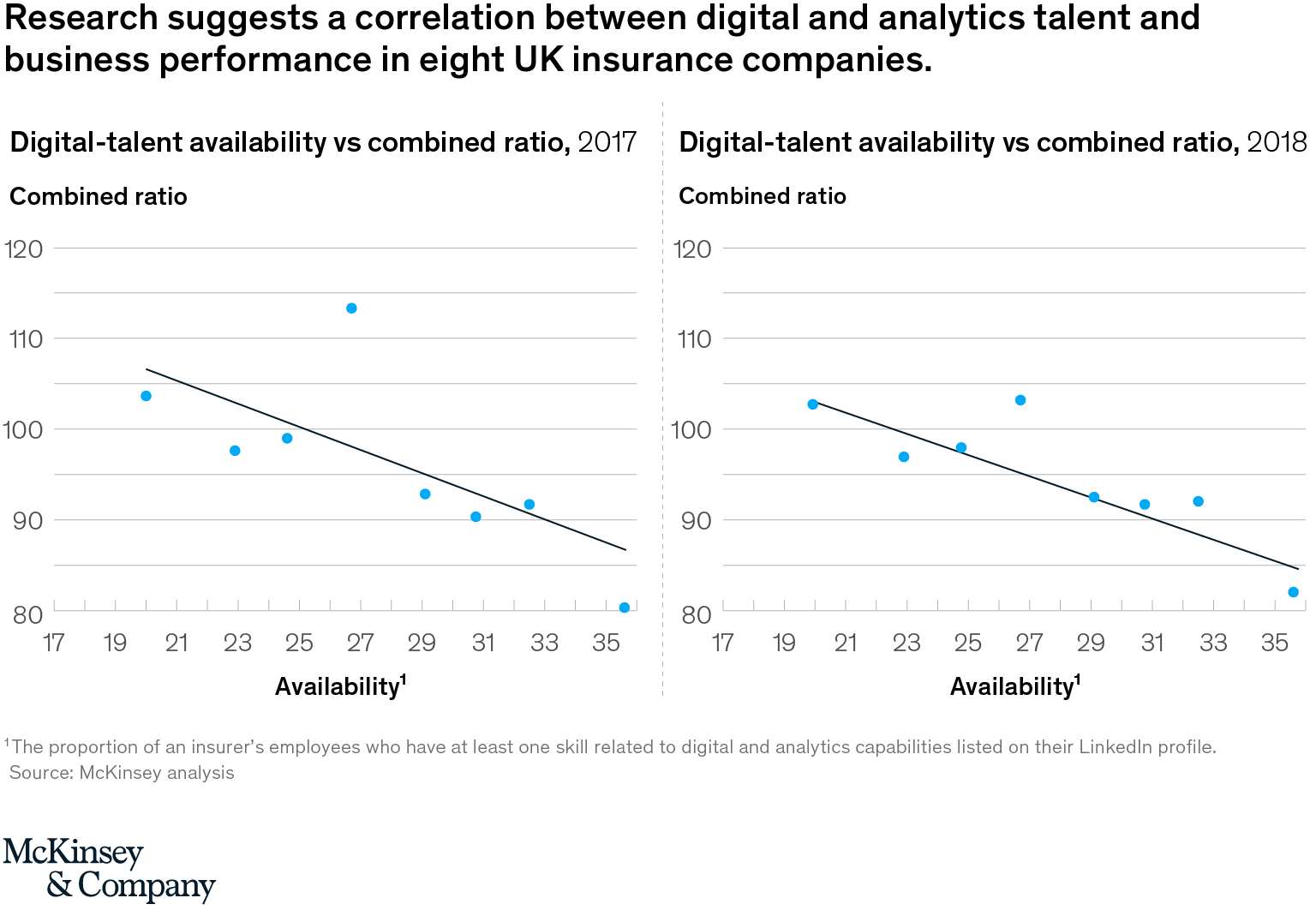

Using a subsample of eight UK insurance companies, we analyzed the relationship between the percentage of digital and analytics talent and profitability in 2017 and 2018.

The analysis showed a strong negative correlation between the availability of digital and analytics talent and company profitability as measured by combined ratios (Exhibit 1). In other words, as the proportion of digital talent increases in companies, the combined ratio decreases, which indicates rising profitability. While correlation does not necessarily mean causation exists, the findings suggest that insurance companies should have a strategy in place to attract and develop tech talent, because this type of talent is strongly linked with business performance. These results may be explained by the presence of greater digital innovation and business efficiency in companies with more digital talent, which in turn translates into stronger company financial performance.

. . . but UK insurers lag behind other industries in tech talent

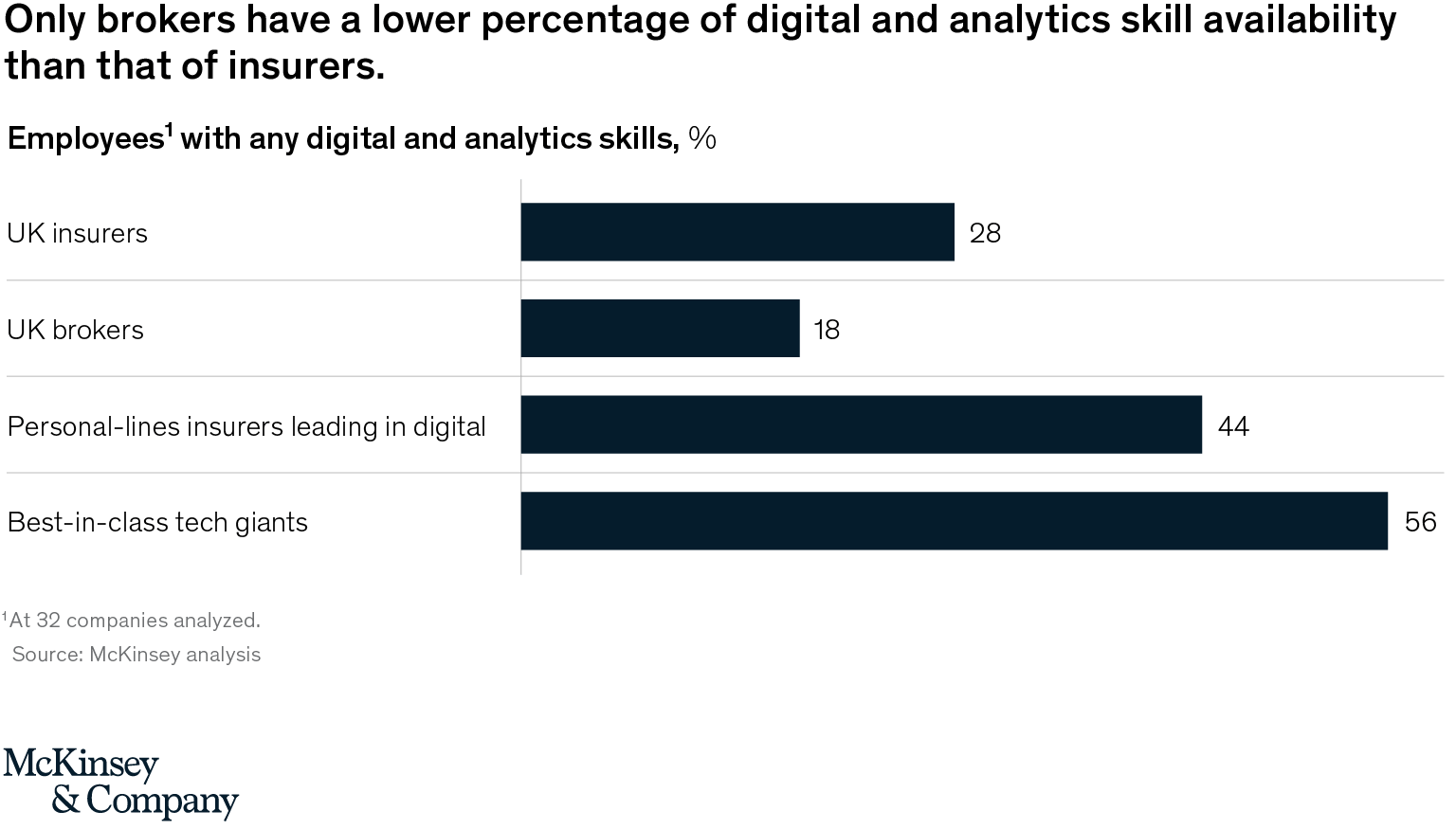

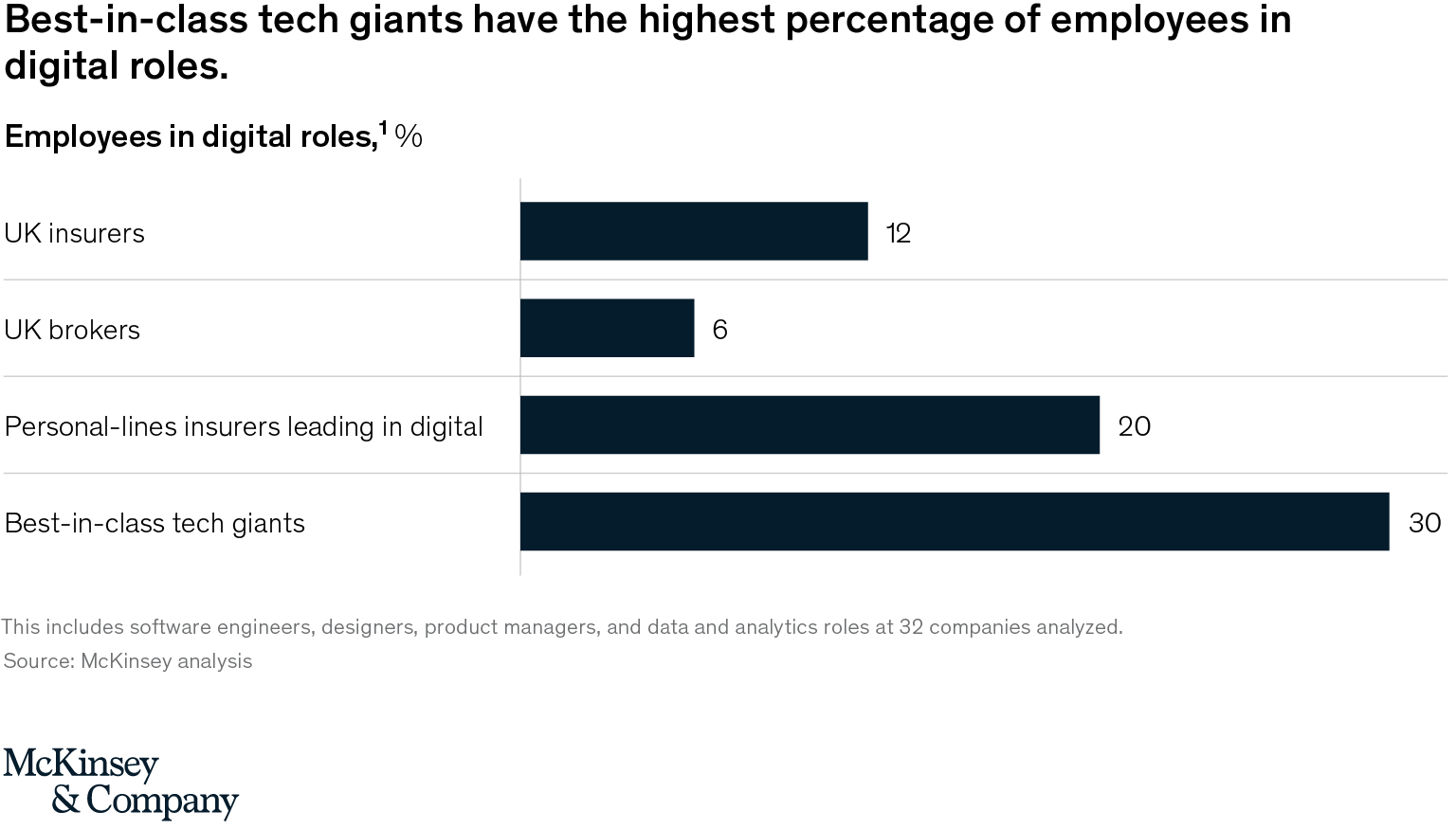

While the correlation between technology talent and profitability is clear, our analysis of the entire sample of 32 companies found that the UK insurance industry is lagging behind in attracting and retaining that talent. Just 28 percent of employees of UK insurance companies possess digital and analytics skills (Exhibit 2), and only 12 percent of employees are in digital and analytics roles such as software engineer, data scientist, and product manager (Exhibit 3). In contrast, 56 percent of employees of the global technology giants we looked at possess digital and analytics skills, and 30 percent are in digital and analytics roles. Insurance carriers also fall behind the best-in-class personal-lines insurers, the group that leads the industry in digital. Trailing insurers are brokers: just 18 percent of their employees possess digital and analytics skills, and only 6 percent are in digital and analytics roles. Indeed, insurers and brokers still lag significantly behind on these skill sets compared with both the tech giants and the personal-line insurance leaders.

Breaking down digital and analytics skills in insurance

Among the 21 UK insurers we analyzed, the most pervasive digital and analytics skills are in the categories of “data and analytics,” which encompasses data science, data analysis, data engineering, and data storage, and “application-development skills,” which includes programming and front- and back-end development. In the former category, employees’ skill sets tend toward data analysis rather than data science. These findings are not surprising, as data analysis is integral to the insurance business model. Data and analytics skills are critical for, among many functions, handling increasing customer demand, improving customers’ ability to compare and purchase products online, and keeping up with the evolution of analytics technologies.

Our analysis dove more deeply into the specific digital and analytics skill sets and tenure of insurance employees, as follows.

Insurers employ more tenured tech talent

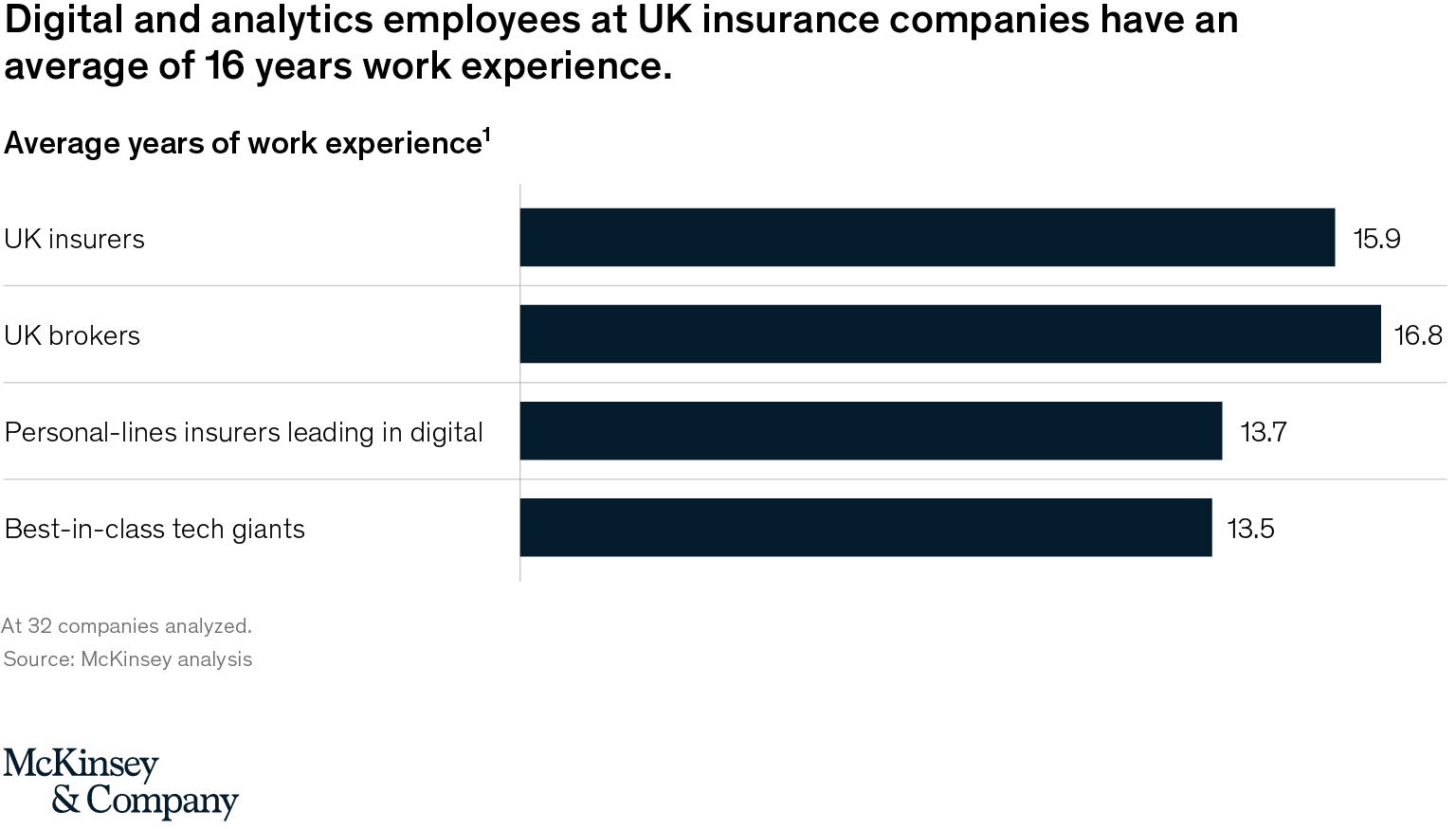

Overall, digital and analytics employees at insurers and brokers have been in their workforces longer than their counterparts have been at personal-lines insurers leading in digital and tech companies (Exhibit 4). This finding correlates with forthcoming McKinsey research that suggests millennial employees who have worked both within and outside of insurance often perceive insurance company culture as stuffy, stifling, and lacking vibrancy. Insurers will need to overcome this perception to move the needle on tech talent.

Our analysis confirms that UK insurers are struggling to attract digital talent—and, to ensure they don’t fall behind, they need to take immediate action. It’s clear that UK insurers would be well served to double down on both recruiting tech talent and training existing employees in the needed skills. Highlighting the exciting opportunities in insurance digital and analytics could help refresh the industry’s image, particularly among younger workers.

Authors’ note: We wrote this piece before the COVID-19 tragedy hit and transformed the lives and livelihoods of us all. After turning our focus to crisis response over the past two months, we reviewed what we had written and agreed that this topic is more urgent and important than ever. The COVID-19 crisis has accelerated the shifts we had already been observing, so we believe the time is right to have this conversation.

About the research

Drawing from our database of anonymized talent profiles, an aggregation of data from various public sources, we compared the digital and analytics skill sets of employees in the UK insurance industry with those of industry peers, brokers, and best-in-class technology companies. We grouped data and analytics skills into six categories, each considered a skill set:

- digital leadership: digital product management, digital project management, digital business analysis

- application design: user research, user-experience (UI/UX) design, graphic design

- application development: programming, enterprise/software architecture, front- or back-end development, mobile-app development, embedded systems, e-commerce

- data and analytics: data science, data analysis, data engineering, data storage

- IT infrastructure and deployment: cloud infrastructure, data center operations, development operations, quality assurance

- information security: governance, risk and compliance, security operations

The talent profiles, extracted from publically available professional websites (e.g. LinkedIn), contain information on individuals’ roles, skills, and work experience. For our analysis, we compared 21 insurance companies of varying size and digital maturity with six insurance brokers and five aspirational companies (three global best-in-class tech giants and two personal-lines insurers that lead in digital). Altogether, these 32 companies employ more than 350,000 people. We also performed a separate profitability analysis on a subset of eight UK insurance companies for which a comparable combined ratio was available.