It’s no secret that the biopharma industry has been grappling with diminishing R&D productivity. R&D investment more than doubled over the last decade, while new molecular-entity approvals plummeted. The return on investment for a typical biopharmaceutical portfolio today often will not even cover its cost of capital.

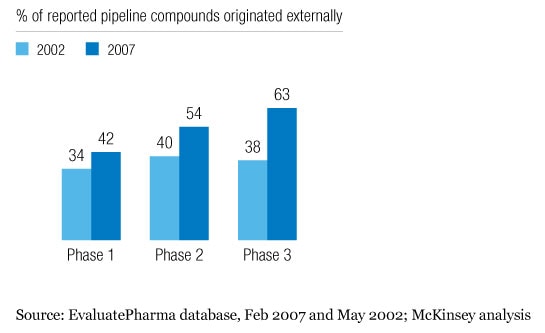

In response, industry players have embarked on a range of initiatives—in particular, externalizing more R&D to increase the number of drug projects and thus the chances of getting a major new product to market. In fact, over half of late-stage pipeline compounds are now externally sourced (Exhibit 1).

This externalization has occurred, for the most part, through fairly traditional models—such as product licensing, program partnerships, or company acquisitions—which favor majority control of assets and put primary responsibility for product development and commercialization in the hands of pharmaceutical companies. Structures have evolved to share the risks and rewards over the course of pharmaceutical-product development, but the split is generally proportional to the degree of resources invested and overall operating control. The proportions may change, depending on the competition for an asset (the higher its perceived desirability, the greater risk and cost a licensee is willing to assume) and the financing environment (biotechs with no financing alternative make their own compromises). But by and large, such variations haven’t fundamentally changed the economics of externalization or dramatically improved the return on external R&D investments.

Outside in

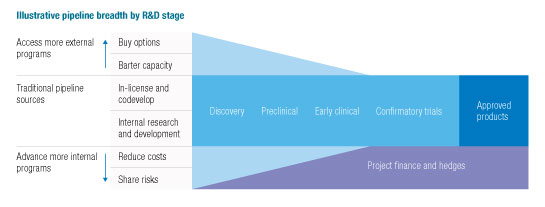

The challenge, in sum, is to increase the number of drug programs to which a pharmaceutical company has access—but without increasing, to the same degree, the capital or resource investment required to access them. Thus, a growing number of companies have begun to pursue novel financing and collaboration models that decouple resource commitments from financial investments, and day-to-day operating control from asset rights, to gain the maximum downstream reward from a program, with minimal up-front risk. Corporate venture investments, for example, can provide an early look at maturing early programs. Options can be purchased to license future successful programs from companies without committing internal resources. And companies can reduce the development risks of internal programs—while retaining control and the financial upside potential—by partnering with contract research organizations, companies in low-cost countries, or private-equity investors to lower development costs, leverage external capacity, and share financial risks (Exhibit 2).

A broad approach

By and large, these models presuppose that much of a deal’s value comes from having preferential rights to a program—and preferential access to the information needed to decide whether to exercise those rights—rather than day-to-day operational responsibilities and the associated commitments of resources and management time.

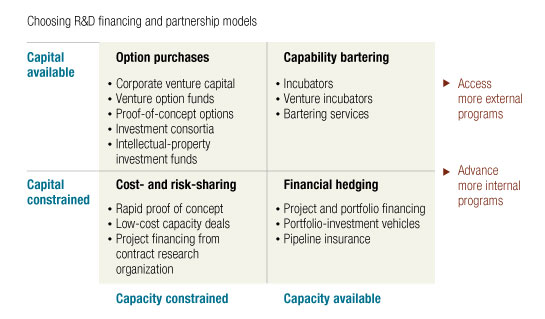

But with so many alternatives, which models should a company apply and in which situations? Companies can and do use different strategies—sometimes concurrently, in different parts of a business—depending on their pipeline, capacity, financing, or risk tolerance. Exhibit 3 provides a simplified framework for deciding among innovative models, with axes representing strategy’s two basic parameters: operating capacity and the availability of financing. A company with plenty of capital to invest but an extremely busy preclinical group, for example, might sign early-stage option deals: the external partner does most of the work through proof of concept, when the pharma company can exercise an option to license the program. By contrast, if a company has sufficient late-stage-development capacity but could not financially weather multiple late-stage product failures, it may want to enter into a portfolio insurance contract to cushion the financial risks of late-stage failure.

Choosing the right model

Although companies ultimately make such decisions on a compound-by-compound basis, the implementation of these alternative R&D-investment approaches has the greatest impact when applied across an entire portfolio to balance the overall risk–reward profile for a company and its investors. A company could, for example, finance high-risk late-stage programs externally to free up capital in order to purchase options on early-stage programs. But companies can also apply these tools selectively to fine-tune the risk–reward profile within segments of a portfolio, allowing a company to respond more flexibly to market opportunities or perceived price/value gaps. A company may partner to access capacity and financing in a capacity-constrained disease area, for instance, while leveraging latent capabilities in other parts of the organization to incubate early-stage companies struggling with the ongoing financial crisis.

It’s important to recognize that while these models can help companies allocate capital and development resources more flexibly, and in some cases to cut operating and capital costs, they’ll enhance R&D portfolio productivity only if they deliver additional successful programs with lower cost or risk. No matter how small the additional investment, advancing more failed programs will drag down portfolio returns. Innovative financing and partnership approaches can improve a program’s financial-risk profile but won’t drive value unless they’re based on sound technical and clinical decision making.

Purchasing low-risk options

Let’s start at the upper-left corner of Exhibit 3’s four-box framework—risk capital available on reasonable terms but operating-capacity constrained or expensive. These models generally aim to create options to access promising programs with the lowest possible up-front commitment of money or resources. By applying different venture-like models, companies can get more information about available external opportunities and gain a preferred position for partnering or acquiring the most attractive assets.

Among these models, corporate venture capital has the longest history. A number of pharmaceutical companies have created venture arms, hoping to enhance deal flow and gain preferential access to attractive compounds. During the five years leading up to 2007, corporate venture capital represented more than 15 percent of all health care venture funding. While the financial returns from corporate venture capital have been buffeted along with the broader market, these investments are generally recognized to contribute strategic value to R&D portfolios.

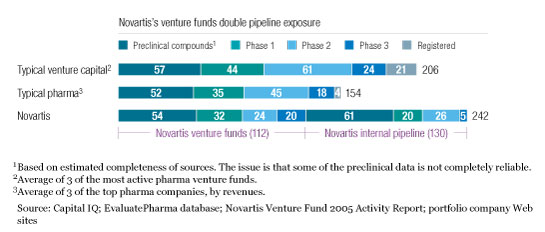

Leading bioscience venture capital firms are exposed to more compounds, with a lower investment per compound, than the largest global pharmaceutical companies, which could similarly enhance their portfolio exposure through venture investments. Since 1996, Novartis AG, for example, has nearly doubled its pipeline exposure by allocating over $650 million—less than 15 percent of its annual R&D budget—to its venture funds (Exhibit 4). These venture investments are made through three complementary vehicles—the original Novartis Venture Fund; the Novartis Option Fund, focused on securing options to specific programs; and a coinvestment fund with MPM Capital. Through these investments, Novartis usually gains access to information about the products of portfolio companies and seeks to couple its investments with options on rights to future products. To date, more than ten portfolio companies have either licensed technologies to Novartis or agreed to collaborate with it.

Doubling

Other companies have pursued a more direct option-based model: they make up-front payments in exchange for rights to specific programs after proof of concept. GlaxoSmithKline, for example, faced constrained resources for traditional early-stage-development partnerships and wanted wider access to scientific talent and opinion. It therefore created its Center of Excellence for External Drug Discovery, which since its formation, in 2002, has forged nearly 15 deals that gave the company options to in-license programs following proof of concept—with minimal up-front research funding, commitment of nonfinancial resources, or day-to-day governance responsibilities. To date, while a few programs have been discontinued, the center’s partnerships with more than ten companies have been expanded or report positive progress. The option approach complements the equity investments made by GlaxoSmithKline’s venture arm, SR One, and supplements the company’s disease-focused internal discovery groups.

A third variation on these early-stage options involves newly emerging investment consortia and intellectual-property investment funds. Last year, for instance, PureTech Ventures created Enlight Biosciences, which is pursuing a precompetitive model for developing breakthrough technologies that could make early drug development more successful. As corporate investors, Eli Lilly, Merck, Novartis, and Pfizer have the opportunity to invest in new technologies and to date have committed over $50 million to Enlight. Two UK-based funds, IP Group and Sloane Robinson, have licensed pools of intellectual property from universities, advanced the technologies to preclinical proof of principle, and then licensed them out or formed new companies around them. By investing in or partnering with such funds, pharmaceutical companies can access early-stage technologies and early-stage-development programs with less risk.

Bartering capabilities

Moving clockwise around the square in Exhibit 3 to the upper-right quadrant of our framework, you will find companies that have capital and at least some excess early-stage operating capacity. The goal: using internal staff, knowledge, and platforms to gain preferential access to external programs. Pfizer, for example, has set up a venture incubator that provides lab space, scientific resources, and management infrastructure to early-stage companies in exchange for preferred rights to their technologies or programs. Amgen and Biogen Idec have committed $100 million each to their corporate venture arms and are directing venture investments toward early-stage incubators. Amgen Ventures was a founding investor in Accelerator, which invests in early-stage opportunities for which Amgen provides access to facilities, scientists, management services, and its vendors. Biogen Idec’s Innovation Incubator (bi3) supplements the company’s New Ventures arm by providing emerging companies with lab and office space, scientific input, business support, and seed financing in exchange for option rights to future development candidates.

Occasionally, pharmaceutical companies may have excess capacity, latent capabilities, or intellectual property that could be bartered, in lieu of cash, for preferential rights to new-product candidates. Rather than licensing or acquiring a novel target outright, for example, a pharmaceutical company may be able to contribute compound libraries, along with screening and lead optimization capabilities, and gain product options in return. Through this services-bartering arrangement, the pharmaceutical company more fully utilizes its valuable infrastructure and gains downstream product rights, while its partner retains near-term operating control over the program and ownership over any assets not optioned by the pharma company.

Sharing development costs and risks

The lower half of Exhibit 3’s four-box framework focuses on alternative investment strategies when capital is relatively tight. Many companies face declining annual cash flows that limit their ongoing ability to invest in internal programs. The strategic response: find ways to lower development costs, access external capacity, and share the financial risks of development, while retaining downstream control of product rights. These innovative risk-sharing models enhance early development’s risk–reward profile by decoupling ownership from activity, commitment from control, involvement from information, and reward from risk.

Lilly’s Chorus model represents the most discussed strategy for companies looking to solve the problem of the lower-left-hand quadrant: maximizing opportunities in capital- and resource-constrained environments. In essence, Chorus is designed to reduce the costs and shrink the operations required to gather enough information about a compound to make an informed decision about full development. The group, small and relatively independent from the main Lilly R&D organization, conducts only critical-path experiments to address proof-of-concept questions. The other necessary (but costly and time-consuming) early-development work, such as formulation, delivery, and manufacturing scale-up, comes after Chorus decides to advance a program. To date, Chorus has advanced two dozen compounds into early development, and half of the ten compounds that have completed proof-of-concept studies have advanced to full development. Chorus’s success has inspired Lilly to seek ways to replicate the model. Recently, the company created Vanthys Pharmaceutical Development, a joint venture with India-based Jubilant Organosys, to combine Chorus’s rapid-proof-of-concept model and Jubilant’s lower-cost structure, thus providing a highly efficient, shared-risk path to clinical proof of concept for compounds that Lilly continues to own.

The deal with Jubilant extends another strategy that Lilly has pursued more broadly: outsourcing to companies in low-cost countries by entering into risk-sharing partnerships. Lilly, Merck, and GlaxoSmithKline have each signed integrated drug discovery and -development alliances with Indian or Chinese biopharmaceutical companies, such as Piramal Healthcare and Ranbaxy Laboratories (now a unit of Daiichi Sankyo). In these deals, the low-cost company takes on development responsibilities for specified programs through proof of concept, when the global pharma company regains rights to the compound in exchange for milestones, royalty payments, and, in some instances, co-promotion rights in certain geographies. Pharmaceutical companies can therefore advance internal programs that would not otherwise meet investment hurdles on a risk-adjusted, full-cost basis.

In the run-up to the creation of Vanthys, Lilly crafted a number of deals to share the costs and risks of early-stage development with low-cost partners. In 2006, it joined with Indian API manufacturer Suven Life Sciences to bring a limited set of central-nervous-system (CNS) candidates into development in exchange for an up-front payment and milestones. Shortly thereafter, Lilly forged a broader risk-sharing deal with Piramal, in which that company is responsible for taking compounds contributed by Lilly through Phase III development, in exchange for milestones and royalties. Because Lilly made no up-front payments, Piramal is in effect providing early-stage project financing for the programs, in addition to low-cost-development capacity. Following this deal, Lilly partnered with Hutchison MediPharma (a division of Hutchison China Meditech), which stands to earn milestones and royalties on successfully developed products, in addition to gaining rights to any compounds Lilly decides not to develop.

Through these low-cost risk-sharing deals, Lilly has dramatically lowered the financial hurdle for advancing early-stage projects, enabling it to pursue more programs, with fewer resources and less capital. The failure of any one of these would not hinder Lilly’s ability to finance other important programs or reduce its appeal to investors, much less risk its viability—the challenge for much larger, more expensive late-stage programs.

Historically, partnering and spin-outs—such as Bristol-Myers Squibb’s partnering of late-stage assets with AstraZeneca and Pfizer—have been the favored ways to transfer late-stage-development risks. Under these approaches, however, it can be challenging for companies to retain a meaningful share of a program’s value in the event of success.

The best-publicized example of a way to access late-stage financing and capacity while maintaining control of programs was a deal announced in July 2008. Quintiles Transnational agreed to conduct Phase III development for two of Lilly’s Alzheimer’s candidates, and TPG-Axon Capital (with a little participation from Quintile’s managed-partnership group, NovaQuest) agreed to finance up to $325 million of development expenses in exchange for milestones and royalties on the products. Through this deal, Lilly accesses Quintiles’ Alzheimer’s-development expertise and transfers much of the programs’ financial risks to TPG-Axon. Lilly can therefore approach Phase III development more aggressively while maintaining control over both programs and freeing up internal resources and capital for other candidates in its pipeline.

According to Novaquest, Lilly has partnered with TPG-Axon on other, undisclosed deals with pharmaceutical companies facing similar capacity and financing constraints that would otherwise force difficult R&D investment trade-offs. Quintiles is also entering into early-stage risk-sharing arrangements, recently announcing an alliance with Eisai. In exchange for milestone payments, Quintiles will finance in part and lead the development of multiple indications for six oncology products through Phase II proof of concept. Pharmaceutical Product Development (PPD) recently announced its intention to spin off its compound-partnering business, with an initial capital commitment of about $100 million, to help the business expand without diluting PPD’s core contract research earnings. These recent developments indicate that the sharing of project finance and risk with clinical research organizations is an increasingly viable alternative for companies to access both the capacity and the financing needed to advance promising programs.

Hedging disproportionate financial risks

Before the global financial crisis, a number of approaches were emerging to help companies share the financial risks of product development while maintaining operating and strategic control. Through these models, product developers can hedge the downside, while retaining most of the financial and strategic value of success. In return, their financial partners earn a premium for taking on risk, which can be spread across other, uncorrelated investments.

By and large, the financial crisis has dramatically reduced the near-term ability of private-equity firms to participate in large, relatively undiversified late-stage project financings, such as TPG-Axon’s funding of Lilly’s Phase III Alzheimer’s programs. But as financial markets stabilize and private capital returns, a variety of financial risk-sharing structures—such as project-based financing, pooled-investment vehicles, or, potentially, forms of pipeline insurance—will probably become available to pharmaceutical developers.

Under Symphony Capital’s pioneering project-financing model, which targets small public companies unable to finance riskier early-stage programs, Symphony assumes the financial risk through clinical proof of concept. In a typical deal, Symphony finances the early clinical development of a portfolio of a company’s programs, taking ownership of them as collateral. Upon completion of proof-of-concept studies, the innovator can either buy back the program (if it’s been successful) at a prenegotiated time-dependent price or leave it in Symphony’s hands (if it hasn’t shown enough promise in the Phase II trial).

This model depends heavily on the biotech’s ability to raise buyback capital through partnerships or the stock market when a Symphony-owned product reaches proof of concept. The stock market hasn’t always cooperated—even positive data sometimes haven’t moved the shares of many biotechs—nor have partnerships always materialized to fund the buybacks. Largely as a result of these market forces, only two of the seven portfolios Symphony funded have been reacquired to date. Symphony recently altered deals with Alexza Pharmaceuticals and OxiGene, restructuring them from project financings to equity investments, because the companies couldn’t raise the cash to buy back their projects on the terms originally negotiated.

Other emerging project-financing models have also been waylaid by the market. Goldman Sachs, building on the Symphony model but targeting much larger companies, had been seeking to create a large pool of capital to finance a diversified set of early clinical programs. Some smaller companies struggling to finance late-stage programs were working with financial partners to create pooled project-financing vehicles enabling multiple investors to finance diversified portfolios of programs under development by multiple public or private companies. These portfolio-investment vehicles would theoretically allow private-equity investors to back hand-picked assets, diversify financial risks across several programs, and generate private-equity returns through a flexible range of exit alternatives. By pooling related and complementary assets—for example, drugs to treat related conditions through alternative mechanisms—partners contributing products to these vehicles could potentially share capabilities, expertise, and infrastructure investments while accessing capital. They would hedge their program risks and still retain much of the upside from their programs.

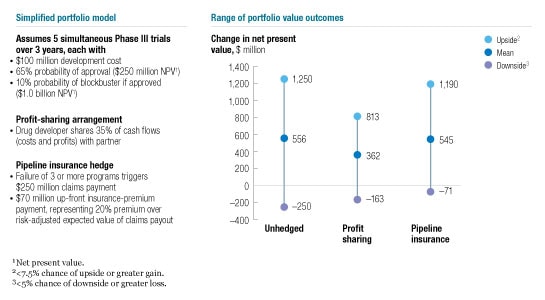

To date, these financing structures have not come to fruition, at least publicly, as a result of the simultaneous downturn of the public markets and decline in the number of partnerships among drug companies. These developments highlight the need for risk-sharing models that don’t depend on volatile equity markets. In the examples we’ve discussed so far, the financial partner has had to commit substantial development capital up front in return for a large share of the upside from success. For pharmaceutical companies with access to lower-cost public capital, an insurance-based model may be more widely appropriate (Exhibit 5). The idea would not be to finance any one program but to hedge against multiple pipeline failures that might threaten a company’s viability, while retaining as much upside as possible in the event of success.

Hedging

Theoretically, under a pipeline insurance model pharmaceutical companies could make up-front “premium” payments to a financial partner, which would agree to reimburse them for a share of the development costs if a catastrophically high proportion of pipeline products failed. Like all insurance plans, such an arrangement would require a financial counterparty who would be concerned about three things. First, the risk must be easy to statistically model and thus price. Late-state clinical-trial statistics based on therapeutic area or mechanism of action should provide a means of risk valuation that rivals or betters those used today in insurance and investment banking. Second, project-specific risk data need to be easily sharable and understandable in order to minimize the risk of adverse selection—no insurer wants the drug developer to insure only the lemons. And since it’s difficult to tell lemons from sweeter fruit before proof of concept, insurance markets probably won’t work for early-stage clinical trials. But the risks may be more manageable in later development, where sharing of clinical proof-of-concept data makes it easier to assess risk and helps level the information playing field. Finally, the clinical program being insured would either need to follow a clearly defined regulatory path or be pursued by an agent other than the insured developer to minimize moral hazard—the danger that the insured may withhold its best efforts from, or engage in riskier development strategies for, the hedged projects.

A suitable counterparty could then manage the risk by holding capital and diversifying or perhaps even creating secondary markets. From the developer perspective, these insurance contracts could preserve a program’s upside while providing downside protection with a predictable up-front cost. Until such counterparties can be engaged, however, R&D pipeline insurance remains theoretical.

Overcoming organizational hurdles

Many people are talking about these strategies. Given rising attrition rates and capital costs, it’s fairly clear that drug companies must access more opportunities without increasing, to the same degree, the resources—cash and operations—they require. But most companies haven’t yet taken meaningful steps toward implementation.

Management teams rightly resist depending on high-cost private equity or sharing future product revenues. But as a result, they often implicitly accept costs and risks across an R&D portfolio without fully assessing the opportunity cost of constrained capacity or the broader potential risks of financial distress. A thorough portfolio review often identifies areas where risk sharing and financial hedges can help balance skewed operating and financial risks.

Such deals aren’t easy for investors, either—particularly given the current financial crisis. But even in good times, investors resist buying into poorly diversified deals; they want a market basket of programs or even opportunities to invest in an entire disease area or a business unit’s pipeline. To the extent feasible, pharmaceutical companies will need to designate broader sets of compounds for inclusion in financing deals.

These companies must also address another important concern: transparency. Investors will worry that pharmaceutical companies won’t be completely forthright about the risks of their programs. To build trust, management teams must therefore support thorough due diligence, just as they would expect it themselves. They’ll also have to explain their motives for wanting to share particular risks and be willing to share fair value in exchange.

There are other internal challenges too. Many executives hesitate to externalize R&D responsibilities as much as these approaches require. The frequent argument against doing so is the poor quality of externally managed development programs. Often, however, executives fear giving up control. Many of these ideas—in particular the early-stage-option programs—require shifting at least early-stage-development control to a partner in return for getting, inexpensively, the information required for good decisions about whether to commit a company to much more expensive downstream development.

Organizational goals must therefore be aligned with these strategies. The mandate of R&D leaders can be broadened, for example, as it is in GlaxoSmithKline’s new Center of Excellence for External Drug Discovery, to encompass internal and external R&D investments. Substantial commitments can be made to separate organizational entities empowered to pursue more aggressive external approaches, as Lilly and Novartis do.

Meanwhile, executives charged with implementing these novel approaches will make mistakes, at times giving up outsized gains in exchange for hedging risks. Given the heightened career risks, companies must give managers incentives to take them. Appropriate amounts of capital should be allocated to these initiatives, for example. Leaders of initiatives should be rewarded for achieving activity-based objectives, such as completed deals, amounts invested, term sheets negotiated, or due-diligence processes completed. These short-term targets should then be balanced by longer-term, value-based incentives tied to investment performance and outcomes across a portfolio of programs.

Since investors have backed off, the financial crisis has given companies an excuse to ignore many alternative financing strategies they should consider. But as financial markets stabilize, private capital will again become available to finance and share the risks of development programs. Lest companies risk missing opportunities to apply these innovative structures, they should prepare today by evaluating portfolio risks and opportunities while building relationships with potential financial and operating partners.

Although a few pharmaceutical companies have made strategically important commitments to one or more of these innovative financing and partnership models, most haven’t moved beyond the experimental stage with even one. But the yes or no outcome of most clinical programs requires a portfolio approach to measure success and distinguish the quality of deal making from the outcome of individual programs. These strategies don’t lend themselves to pilot exercises, so companies must apply them at scale to make a meaningful impact. Companies that learn to use a range of innovative financing and partnership models efficiently and flexibly across portfolio stages and business units will maximize the number of R&D programs they can advance and thus transform their overall R&D productivity.