|

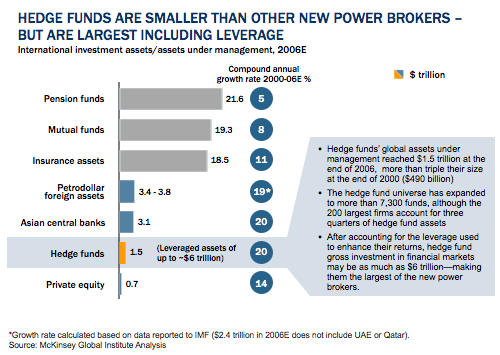

| Hedge funds had global assets under management of $1.7 trillion at the end of the second quarter 2007, up from just $490 billion at the end of 2000. Including leverage, hedge fund gross investments may be as high as $6 trillion. In MGI's base case, hedge fund assets grow more slowly than recently, but still reach $3.5 trillion by 2012—or $12 trillion with leverage, vaulting hedge funds to roughly one-third the size of global pension funds. | ||