Client goal

Our client is GlobaPharm, a major pharmaceutical company (pharmaco) with $10 billion a year in revenue. Its corporate headquarters and primary research and development (R&D) centers are in Germany, with regional sales offices worldwide.

Description of situation

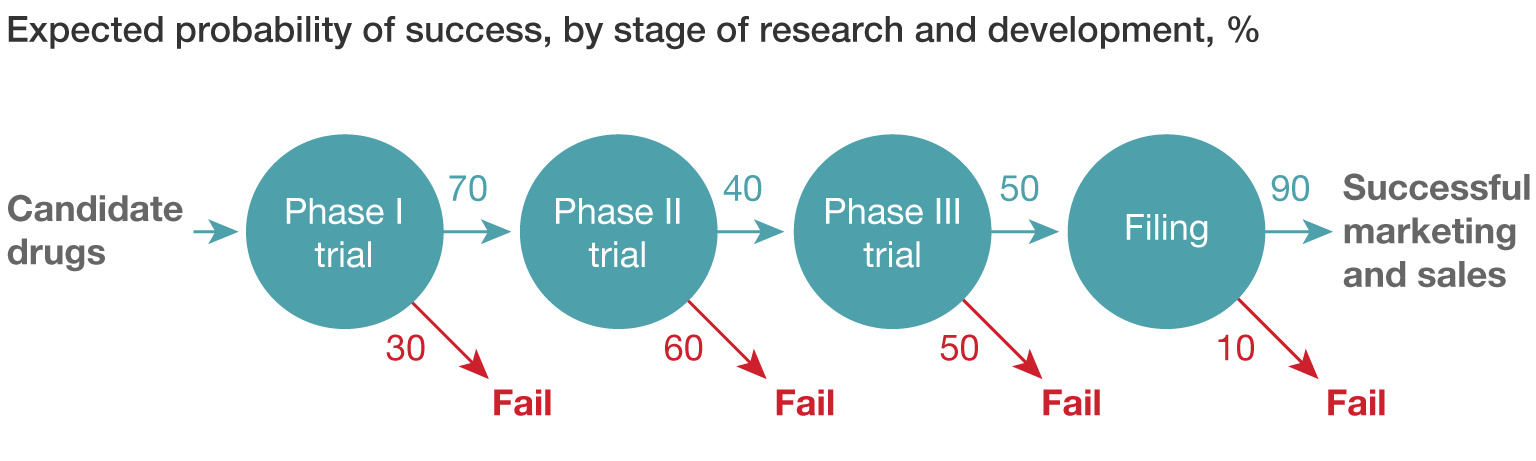

GlobaPharm has a long, successful tradition in researching, developing, and selling “small molecule” drugs. This class of drugs represents the vast majority of drugs today, including aspirin and most blood-pressure or cholesterol medications. GlobaPharm is interested in entering a new, rapidly growing segment of drugs called “biologicals.” These are often proteins or other large, complex molecules that can treat conditions not addressable by traditional drugs.

R&D for biologicals is vastly different from small-molecule R&D. To gain these capabilities, pharmacos have three options: they can build them from scratch, partner with existing start-ups, or acquire the start-ups. Since its competitors are already several years ahead of GlobaPharm, GlobaPharm wants to jumpstart its biologicals program by acquiring BioFuture, a leading biologicals start-up based in the San Francisco area. BioFuture was founded 12 years ago by several prominent scientists and now employs 200 people. It is publicly traded and at its current share price the company is worth about $1 billion in total.

McKinsey study

GlobaPharm has engaged McKinsey to evaluate the BioFuture acquisition and to advise on its strategic fit with GlobaPharm's biologicals strategy. Our overall question today, therefore, is “Should GlobaPharm acquire BioFuture?”

Helpful hints

- Write down important information.

- Feel free to ask the interviewer for an explanation of any point that is not clear to you.

- Remember that calculators are not allowed - you may write out your calculations on paper during the interviews.