With the 2010 FIFA World Cup well over, the international sports spotlight has moved on from South Africa to other tournaments in other lands. Still, European companies and investors should keep their eyes on Africa because competition in commerce is heating up across the continent.

A new report from the McKinsey Global Institute shows that Africa is now among the fastest-growing economic regions in the world, creating significant business opportunities in a wide range of industries. Early entrants onto the field can seize the advantage.

Africa's collective gross domestic product rose at a 4.9 percent annual rate from 2000 through 2008, twice the pace of the preceding two decades. In our report, "Lions on the move: The progress and potential of African economies," we show that this growth surge was broadly based, with roots extending far beyond the global commodities boom.

Looking ahead, we project that at least four groups of industries on the continent could together generate as much as $2.6 trillion in annual revenue by 2020, or $1 trillion more than today, measured in 2010 dollars. The biggest business opportunity of the four lies in consumer goods and services, followed by natural resources, agriculture, and infrastructure.

These projections reflect Africa's recent economic advances and strong long-term prospects. The continent's combined economic output, valued at $1.6 trillion in 2008, is now roughly equal to Brazil's or Russia's. Several factors suggest that this economic momentum can be sustained.

1. A surge of peace and economic reform

To start, Africa's growth acceleration was widespread, with GDP rising more rapidly in 27 of its 30 largest economies—both in countries with significant resource exports and in those without. Rising revenues from oil, minerals, and other natural resources accounted for just 24 percent of growth from 2000 through 2008. All the other sectors contributed as well, including finance, retail, agriculture, and telecommunications.

Key to the growth surge were government reforms that created greater political stability, improved the macroeconomic environment, and energized the business environment. For example, several countries halted their deadly conflicts. Policymakers also reduced inflation, cut budget deficits, lowered trade barriers, cut taxes, privatized companies, and liberalized many sectors, such as banking.

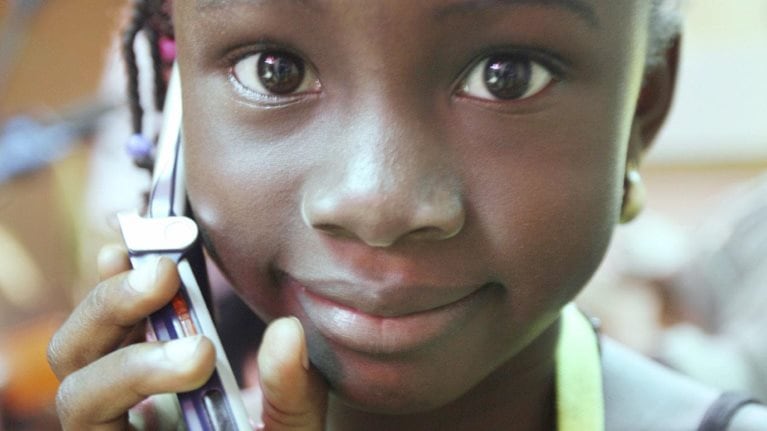

As a result, a dynamic African business sector is emerging. The continent now has more than 1,400 publicly listed companies. It boasts more than 100 companies with revenue greater than $1 billion. Telecom firms have signed up more than 316 million new mobile-phone subscribers in Africa since 2000—more than the total US population. Banking and retail are flourishing as household incomes climb. Construction is booming as new cities rise.

Africa's future economic growth likely will be supported by several long-term trends. Among these is the rising global demand for oil, gold, diamonds, and other commodities. This demand is growing fastest in the world's emerging economies, particularly in Asia and the Middle East. Despite historic ties with Europe, Africa now conducts half its total trade with developing economic regions—so-called south-south exchanges. Asia's economies altogether accounted for 28 percent of Africa's total trade in 2008, more than double their share in 1990. Western Europe's share shrank during the same period, from 51 percent to 28 percent.

2. Growing urbanization, solar energy

There is great potential for Europe to revitalize its old links to Africa and forge new ones. One place to start is by looking beyond Africa's raw materials to a bigger source of future economic growth: the rise of the urban African consumer. Today, 40 percent of Africans live in cities, a proportion that is close to China's and continuing to expand. The continent already has 52 cities with populations greater than 1 million—equal to Western Europe—and is projected to add 32 by 2030. As in other developing economies, urbanization in Africa is creating jobs, boosting productivity, and lifting incomes. The number of households with discretionary income is projected to grow by 50 percent over the next 10 years, reaching 128 million.

Africa's household spending totaled $860 billion in 2008, more than that of India or Russia. The continent's consumer markets are already growing two to three times faster than those in Organization for Economic Co-operation and Development (OECD) countries and could be worth $1.4 trillion in annual revenue by 2020. With their eyes on this prize, many European companies are already expanding in Africa: Unilever (UL), Standard Chartered (SCBFF), and SABMiller (SBMRY) each operate in a dozen or more of the continent's 50-plus countries.

Urbanization also is increasing demand for investment in new roads, rail systems, clean water, power generation, and other infrastructure in Africa. Some companies see additional opportunities for Africa to become an exporter of clean energy. Consider the Desertec Industrial Initiative, launched by a consortium of European companies including Siemens (SI), which aims to transmit power to Europe from a network of solar plants and wind farms to be built across the deserts of North Africa and the Middle East. The project still faces technical hurdles and will take years to realize, but the effort could yield an estimated $400 billion in local investment.

3. Ripe for a "green revolution"?

Many companies also are finding opportunities to serve European customers from Africa. In North Africa, several countries are using their proximity and linguistic ties to Europe to attract more foreign investment in tourism, offshore business services, and low-cost manufacturing for export.

Africa's new commercial vibrancy also holds many other possibilities. With 60 percent of the world's uncultivated arable land and low crop yields, Africa is ripe for a "green revolution" such as those that have increased agricultural production in Asia and Brazil. We estimate that the total value of Africa's resource sectors' production could grow steadily, from 2 percent to 4 percent a year, over the next decade.

To be sure, there remain serious challenges and risks to growth in any individual country. But if recent trends continue, Africa will play an increasingly important role in the global economy. By 2040, the continent will be home to one in five of the planet's young people and will have the world's largest working-age population. If Africa can give its young people sufficient education and skills, they could be a substantial source of consumption and production in years ahead.

European executives and investors cannot afford to ignore Africa's immense economic potential. Nor can they assume that traditional ties will guarantee them an advantage in the competition. There are many new players but also many new chances to get in the game and gain some ground.

The authors wish to acknowledge the contributions of Norbert Dörr, Mutsa Chironga, Acha Leke, Amine Tazzi-Riffi, and Arend Van Wamelen in McKinsey's Africa offices.

Charles Roxburgh is the London-based director of the McKinsey Global Institute (MGI), McKinsey's business and economics research arm. Susan Lund is MGI's director of research, based in Washington, D.C.

This article originally ran in Bloomberg Businessweek.