Combining economic and social development with financial modeling expertise to build new cities and redevelop existing ones.

A recent report by the McKinsey Global Institute, Urban world: Cities and the rise of the consuming class, suggests that by 2025, more than half the world’s population will live in megacities of 10 million or more people. Some of these urban dwellers, for the first time ever, will have incomes high enough to classify them as consumers. All of them will contribute significantly to spending and GDP. At the same time, their demands on infrastructure will be great. In fact, to meet the needs of these urban consumers, cities must invest heavily in infrastructure and building space. Managing these investments, while encouraging economic growth and safeguarding natural resources is a difficult task. We can help. We focus on planning and developing cities that support growth, without compromising environmental or social sustainability.

What we do

We work with regional governments, urban planners, foundations, non-profits, utilities, and businesses to plan and develop new cities and redesign existing urban areas. Our consultants collaborate with colleagues in complementary practices, such as Travel, Logistics & Infrastructure, Sustainability, and Public & Social Sector, to bring cutting-edge solutions to our clients. Throughout the lifetime of a project, we work closely with clients to build their capabilities and ensure the sustained impact of these projects. Our role includes:

- developing economic master plans for new and existing development zones

- assessing the requirements for and economic feasibility of major infrastructure associated with development

- modeling the economic and environmental impact of major infrastructure on cities

- evaluating and launching performance improvement programs for major city infrastructure-related services

- providing project management support to establish and develop major urban infrastructure projects

Examples of our work

- We worked with a private client and landowner that was interested in developing a new African city. We helped the client define a financing strategy for necessary infrastructure and develop the economic strategy for this city of 500,000. We collaborated closely with all stakeholders to ensure both strategies were in line with the country’s broader development plans.

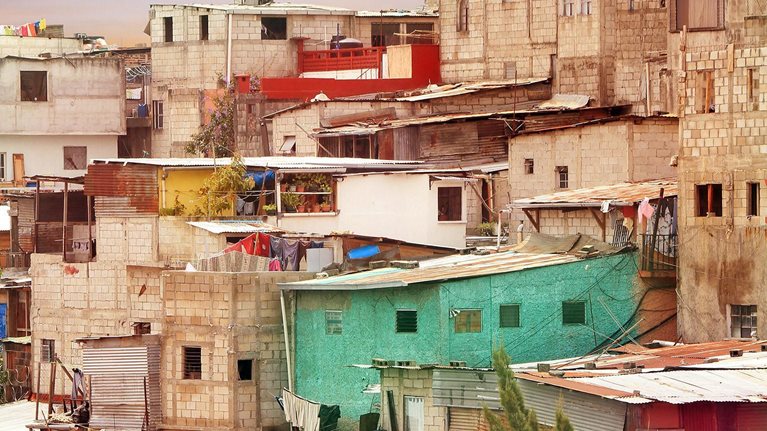

- We helped a populous Latin American city redevelop a large urban area for mixed use. Given the size of its existing population and anticipated growth, the area faced significant infrastructure and funding gaps, plus environmental challenges. We supported the city in creating an actionable plan to make the area: operationally self-sufficient, aligned with the city’s cultural and environmental objectives, and amenable to future complex upgrades and additions.

- We advised a large European city faced with a chronically overcrowded its urban center. With a population exceeding 11 million, the city’s roads were constantly jammed. Its public transport systems were also overloaded with passengers. First, we supported the client in analyzing current and future public transport demand and economics and in developing plans for a high-capacity urban transit system to service the city center and surrounding areas. We then helped the client define and implement a new parking policy to properly organize city parking and decrease the number of cars parked illegally, a new taxi policy to increase the availability of safe, legal taxis, and a program to better manage existing public transport operators and ensure adequate competition.

Featured solutions

We have developed and tested a broad set of tools and solutions to better serve our clients, including:

- Infrastructure sizing tool enables us to calculate the size and cost of key infrastructure assets, such as water, sewage, and power, based on certain drivers, including population, number of jobs, and land area.

- Greenfield land valuation tool allows us to calculate the sale price of land based on the expected return profile for developers, affordability constraints for real estate assets, and other factors.